SSC GD Salary Per Month: The Staff Selection Commission (SSC) General Duty (GD) Constable examination is a prestigious opportunity for individuals aspiring to serve in central paramilitary forces and security organizations. Along with the honor of serving the nation, the role provides an attractive salary structure. This article offers a detailed breakdown of the SSC GD Salary, covering in-hand salary, gross earnings, allowances, and benefits.

Understanding SSC GD Salary Per Month Structure

The salary structure for SSC GD Constables is determined by the 7th Central Pay Commission (7th CPC). It consists of several components, including basic pay, allowances, and deductions, resulting in a substantial in-hand salary. Let’s explore this structure step by step.

Certainly, here’s a breakdown of the SSC GD Salary in a tabular format, based on the latest DA of 56% and HRA rates:

| Salary Component | Amount (₹) | Description |

|---|---|---|

| Basic Pay | 21,700 | The core component of the salary. |

| Dearness Allowance (56%) | 12,152 | 56% of Basic Pay to offset inflation. |

| HRA | Based on the city of posting: | |

| – X Cities (30%) | 6,510 | Metro cities. |

| – Y Cities (18%) | 3,906 | Towns. |

| – Z Cities (10%) | 2,170 | Rural areas. |

| Transport Allowance | Varies by location: | |

| – Class A Cities | 3,600 | Larger cities. |

| – Other Cities | 1,800 | Smaller towns and rural areas. |

| Other Allowances | 2,000 (approx.) | Includes Risk, Hardship, Dress, etc. |

| Gross Salary | 45,962 (approx.) | Sum of all components for X Cities example. |

Deductions

| Deduction Component | Amount (₹) | Description |

|---|---|---|

| Provident Fund (12%) | 2,604 | 12% of Basic Pay. |

| NPS Contribution (10%) | 2,170 | 10% of Basic Pay. |

| Income Tax | Minimal | For lower income tax bracket employees. |

Net In-Hand Salary

| Net In-Hand Salary | Amount (₹) |

|---|---|

| After Deductions | 41,188 (approx.) |

MP Police Salary Hike After 8th Pay Commission— How Much Will You Earn?

1. Basic Pay

The Basic Pay forms the foundation of the salary package. For SSC GD Constables, the initial basic pay is ₹21,700 per month. This amount increases over time with increments and promotions.

Pay Matrix Level

SSC GD Constables fall under Pay Level-3 of the 7th CPC, ensuring a well-defined growth trajectory.

2. Gross Salary

Gross salary refers to the total earnings before deductions. It is calculated by adding basic pay and various allowances. Here are the key components that contribute to the gross salary:

a. Dearness Allowance (DA)

- DA is calculated as a percentage of the basic pay and is revised periodically to account for inflation.

- As of now, DA stands at 56% of Basic Pay, which amounts to ₹12,152.

b. House Rent Allowance (HRA)

HRA depends on the city of posting and is categorized into three tiers:

- X Cities (Metro cities): 30% of Basic Pay = ₹6,510

- Y Cities (Towns): 18% of Basic Pay = ₹3,906

- Z Cities (Rural areas): 10% of Basic Pay = ₹2,170

c. Transport Allowance (TA)

- SSC GD Constables receive a fixed Transport Allowance:

- ₹3,600 for Class A cities

- ₹1,800 for other cities

d. Other Allowances

- Includes Risk and Hardship Allowances, Dress Allowance, and Special Duty Allowance (for postings in challenging areas).

Estimated Gross Salary (Example for X Cities)

- Basic Pay: ₹21,700

- DA (56%): ₹12,152

- HRA (30% for X Cities): ₹6,510

- TA: ₹3,600

- Other Allowances: ₹2,000 (approx.)

- Total Gross Salary: ₹45,962 (approx.)

3. In-Hand Salary

In-hand salary refers to the amount credited to the employee’s account after deductions are made. Typical deductions include:

a. Provident Fund (PF)

- 12% of Basic Pay: ₹2,604

b. National Pension System (NPS)

- Approximately 10% of Basic Pay: ₹2,170

c. Income Tax

- Minimal tax deductions, as SSC GD Constables fall under lower income tax brackets.

Estimated In-Hand Salary

- Gross Salary: ₹45,962

- Total Deductions: ₹4,774 (approx.)

- Net In-Hand Salary: ₹41,188 (approx.)

4. Benefits and Perks

SSC GD Constables enjoy several benefits that enhance the overall compensation package:

a. Job Security

- A stable central government job offering unmatched stability.

b. Pension Scheme

- Financial security through the National Pension System (NPS).

c. Medical Facilities

- Access to comprehensive healthcare for employees and their dependents.

d. Gratuity

- A lump sum payment upon retirement or resignation, ensuring long-term support.

e. Leave Travel Concession (LTC)

- Subsidized travel benefits within India.

f. Housing Benefits

- Access to affordable government accommodation.

g. Insurance Coverage

- Coverage under the Group Insurance Scheme.

5. Career Growth and Increment Opportunities

SSC GD Constables have ample opportunities for career advancement through promotions and departmental exams. The hierarchy typically follows this path:

- Constable

- Head Constable

- Assistant Sub-Inspector (ASI)

- Sub-Inspector (SI)

- Inspector

Each promotion entails higher pay scales and greater responsibilities, ensuring continuous growth.

6. Factors Influencing Salary Variations

The salary of SSC GD Constables can vary due to:

- Posting Location: Urban versus rural allowances.

- Nature of Duty: Additional allowances for postings in challenging regions.

- Years of Service: Incremental hikes based on tenure.

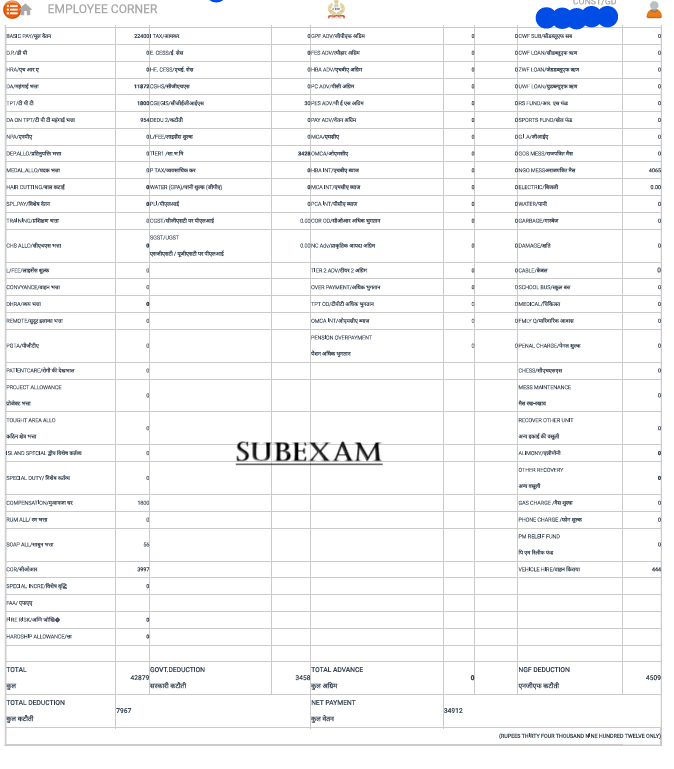

7. Salary Slip Of Ssc GD 2025/ CRPF/ CISF/ BSF

CRPF SALARY SLIP 2025:

CISF SALARY SLIP 2025:

Frequently Asked Questions (FAQs)

- What is the gross monthly salary of an SSC GD Constable? The gross salary ranges between ₹21,700 to ₹69,100 per month, including allowances.

- What is the approximate in-hand salary after deductions? The in-hand salary is around ₹35,527, depending on specific deductions.

- What allowances are included in the salary structure? Key allowances include Dearness Allowance (DA), House Rent Allowance (HRA), and Transport Allowance (TA).

- What deductions are made from the gross salary? Deductions include contributions to pensions, CGHS, and CGEGIS.

- Are SSC GD Constables eligible for medical benefits? Yes, they are covered under the Central Government Health Scheme (CGHS).

- What is a salary slip, and how can it be used as proof? A salary slip is an official document detailing earnings and deductions, serving as proof of salary.

- What other benefits do SSC GD Constables receive apart from salary? Benefits include pension schemes, paid annual leaves, and field allowances for challenging postings.

- Does the salary structure change based on location? Yes, allowances like HRA vary depending on whether the posting is in urban, semi-urban, or rural areas.

- How is the salary calculated according to the 7th Pay Commission? The 7th Pay Commission determines basic pay scales, allowances, and deductions to ensure fair compensation.

- What is the process for salary revision or promotion? Salary is revised periodically, and promotions are based on performance and seniority, with corresponding pay scale adjustments.

Conclusion

The SSC GD Constable salary structure is a blend of competitive pay, stable career growth, and extensive benefits. It reflects the central government’s commitment to its workforce, offering monetary rewards alongside the honor of serving the nation. Whether you are considering this career path or preparing for the SSC GD examination, understanding the salary components can motivate and guide your efforts.

The journey begins with determination and preparation—success is just a step away.